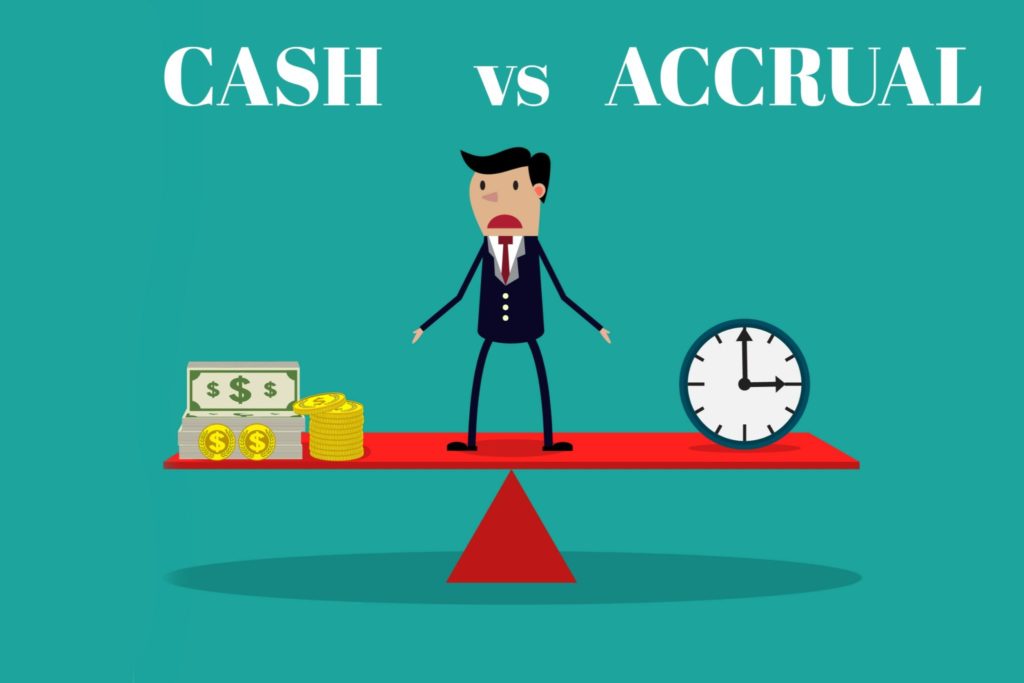

One of the most important choices you’ll have to make when it comes to handling the financial affairs of your Palm Beach Gardens, Florida firm is between accrual and cash accounting. Choosing the best approach for your company can have a big impact on your financial reporting and decision-making procedures because both offer benefits and cons as advised by an accountant in Palm Beach Gardens, FL. We’ll examine the distinctions between accrual and cash accounting in this blog post and offer advice to assist you make the best choice possible for your Palm Beach Gardens, Florida company.

Cash Accounting:

A simple technique for keeping track of transactions when money is exchanged is cash accounting. This means that costs are recorded when they are paid, and revenue is recognized when it is received. For small firms with simple financial transactions, it’s a popular option.

Advantages of Cash Accounting:

- Simplicity: Cash accounting is simpler to implement and maintain, making it an attractive option for small businesses with limited resources.

- Cash Flow Focus: Since it tracks actual cash movements, this method provides a clear picture of your business’s cash flow at any given time.

- Tax Advantages: Businesses can potentially defer taxes by delaying the recognition of income until the following tax year.

Accrual Accounting:

Accrual accounting, on the other hand, recognizes revenue and expenses when they are incurred, regardless of when the actual cash transactions occur. This method provides a more comprehensive view of your business’s financial health, as it reflects all economic activities during a specific period.

Advantages of Accrual Accounting:

- Accurate Financial Picture: Accrual accounting provides a more accurate representation of your business’s financial position, allowing for better decision-making.

- Matching Principle: This method aligns revenues and expenses, providing a more accurate portrayal of your business’s profitability during a specific time frame.

- Better Reporting: Accrual accounting is often required for businesses seeking external financing or complying with certain regulatory standards.

Selecting accrual versus cash accounting is a critical choice that might affect your financial reporting and management in Palm Beach Gardens, Florida. To make an informed choice, evaluate your company’s size and complexity, industry norms, long-term objectives, and tax implications. The prosperity and financial stability of your company in this thriving Florida neighborhood depend on your decision about accrual accounting vs cash accounting. Cash accounting offers greater precision