Introduction: The Global Race for Outsourced Development

In 2025, the global IT outsourcing market is no longer dominated by a single region. The post-AI boom has leveled the playing field, pushing clients to rethink where and how to build software efficiently.

According to Statista (2025), the IT outsourcing market is projected to exceed $587 billion by 2027, growing at a CAGR of 8.4%.

Today’s buyers no longer optimize just for price — they prioritize talent quality, time-zone alignment, resilience, and cultural fit.

Let’s explore the five regions competing for global outsourcing contracts, their models, and why Ukraine remains one of the strongest contenders despite external challenges.

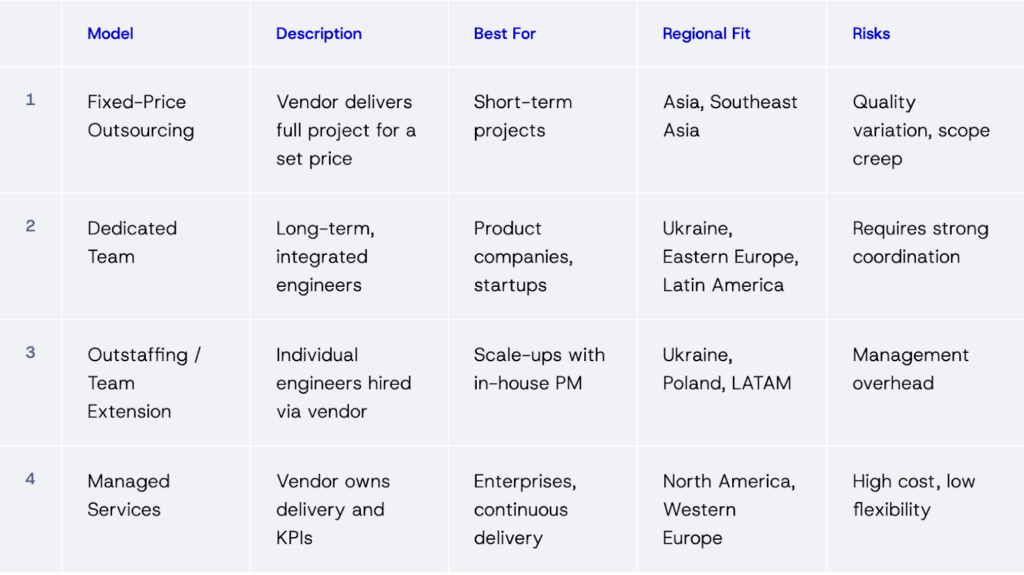

1. Choosing the Right Model: How Geography Shapes Engagement

Before comparing regions, it’s vital to understand that the engagement model defines the outcome. The region’s maturity, talent base, and cost levels affect which model works best.

Key takeaway:

Location choice impacts project governance — the more complex and strategic your work, the more important cultural and time-zone alignment becomes.

2. The Top 5 Regions Competing for Global Contracts

2.1 South Asia — Scale and Affordability

Countries: India, Pakistan, Bangladesh

- Strengths: World’s largest IT talent pool; decades of BPO/outsourcing expertise.

- Trade-offs: Time-zone gap for EU/US, high engineer turnover.

- Market Share: India holds ~17.6% of global software outsourcing (Dreamix, 2025).

- Model Fit: Excellent for fixed-price and high-volume delivery.

When to choose: If you need cost-efficient delivery of large, well-defined projects with minimal collaboration dependency.

2.2 Southeast Asia — Emerging Talent Hubs

Countries: Vietnam, Philippines, Malaysia

- Strengths: Competitive cost, strong English proficiency (Philippines), young tech workforce.

- Trade-offs: Smaller vendor ecosystems, less experience with complex enterprise projects.

- Market Share: Philippines holds ~13.5% (Dreamix, 2025).

- Model Fit: Ideal for startups and back-office functions; rising in software testing and QA.

When to choose: If you’re experimenting with smaller projects or require flexible QA or support services.

2.3 Latin America — Nearshore Advantage for the US

Countries: Brazil, Mexico, Argentina, Colombia

- Strengths: Time-zone overlap with North America, cultural affinity, solid education.

- Trade-offs: Cost premium vs Asia; limited talent scalability in smaller countries.

- Market Share: Brazil contributes ~12.5% (Dreamix, 2025).

- Model Fit: Excellent for dedicated teams, especially for U.S. startups seeking seamless collaboration.

When to choose: If proximity and real-time collaboration are crucial for agile or product-driven work.

2.4 Eastern Europe — The Quality and Reliability Hub

Countries: Ukraine, Poland, Romania, Czech Republic

- Strengths: Top-tier engineers, strong STEM education, shared work culture with Europe.

- Trade-offs: Slightly higher rates than Asia; geopolitical instability in some areas.

- Market Share: Poland — 12.1%, Ukraine — 10.4%, Romania — 8.7% (Dreamix, 2025).

- Model Fit: Ideal for dedicated teams and data-intensive projects.

When to choose: When quality, communication, and long-term integration matter more than the lowest hourly rate.

2.5 North America / Western Europe — On-shore Maturity

Countries: US, Canada, UK, Germany, Netherlands

- Strengths: Complete cultural alignment, advanced vendor maturity, clear IP protection.

- Trade-offs: High costs (2–3× Eastern Europe), limited scalability for large offshore teams.

- Regional Share: EMEA ~28% of global outsourcing spend (Zealousys, 2025).

- Model Fit: Managed services and complex enterprise outsourcing.

When to choose: When compliance, data governance, or co-creation with local vendors are your top priorities.

3. Why Ukraine Holds Its Ground

Despite ongoing geopolitical challenges, Ukraine remains one of the most resilient IT ecosystems in the world.

Strengths:

- High expertise density: ~300,000 IT professionals; 70% of companies specialize in software development (IT Ukraine Association, 2025).

- Top global ranking: #1 in Eastern Europe for the number of IT certifications per capita (SkillValue Report).

- Cultural alignment: Similar work ethics and communication style as Western Europe.

- Stable delivery despite war: IT export revenue reached $6.4 billion in 2024, just a 4.2% decline year-over-year (AIN, 2025).

Challenges:

- Infrastructure risks and security insurance costs.

- Occasional relocation of teams to safer regions.

- Perception risk for conservative investors.

Resilience:

Most Ukrainian IT companies adopted distributed operations, moving data centers and staff to Western Ukraine or EU countries.

The result: 90% of IT companies continue to deliver without interruptions (Lviv IT Cluster Survey, 2025).

When to choose Ukraine:

When you need a strategic, technically mature, near-shore partner capable of handling complex integration, BI, and data-driven systems with a European mindset and cost efficiency.

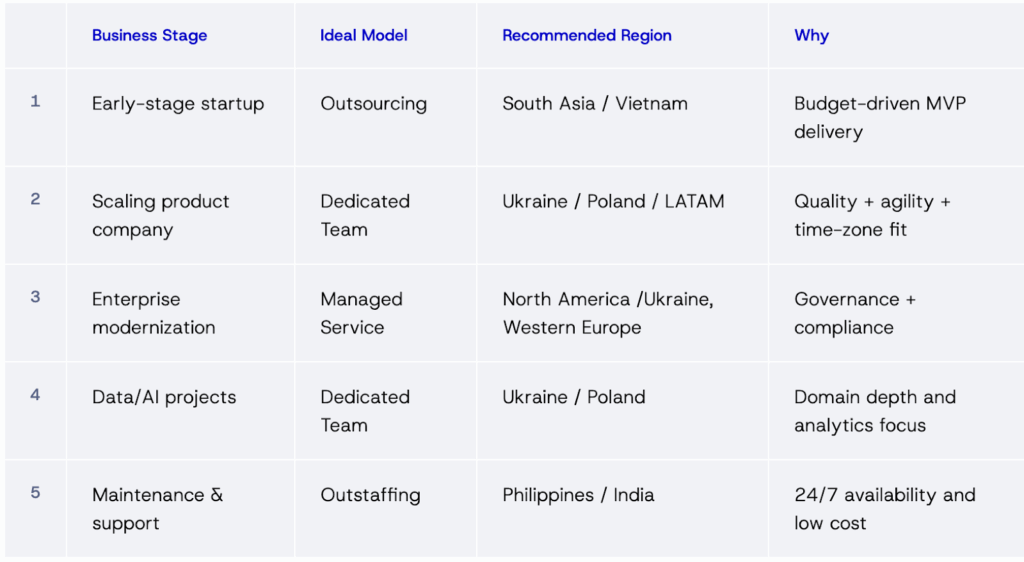

4. Comparing Models and When to Choose Each (2025 Edition)

5. Outlook: The Global Map Is Flattening

By 2027, Gartner predicts that 70% of global organizations will use a hybrid outsourcing model — blending local governance with distributed development.

Regions are no longer competing solely on price, but on trust, predictability, and integration.

Ukraine, Poland, Vietnam, and Brazil represent the “smart outsourcing” generation — combining skill, proximity, and adaptability.

Conclusion: The Future Belongs to Resilient Partnerships

Outsourcing is no longer a procurement decision — it’s a strategic investment in capability.

Choosing the right region depends on your risk tolerance, cultural needs, and product vision — not just the hourly rate.

Ukraine exemplifies this evolution: a country that transformed crisis into global competitiveness through resilience, skill, and European alignment.

For buyers seeking predictable delivery with strong human partnership, Ukraine is not just holding its ground — it’s defining what modern outsourcing looks like.